The World Has a Critical Metals Problem

Western governments face a structural shortage of domestically processed critical minerals essential to defense, energy, and advanced manufacturing.

- China controls 60-90% of global refining capacity across multiple critical minerals

- Mining supply exists; processing capacity does not

- Governments are shifting from free trade to strategic stockpiling + domestic refining

Singta builds the missing infrastructure.

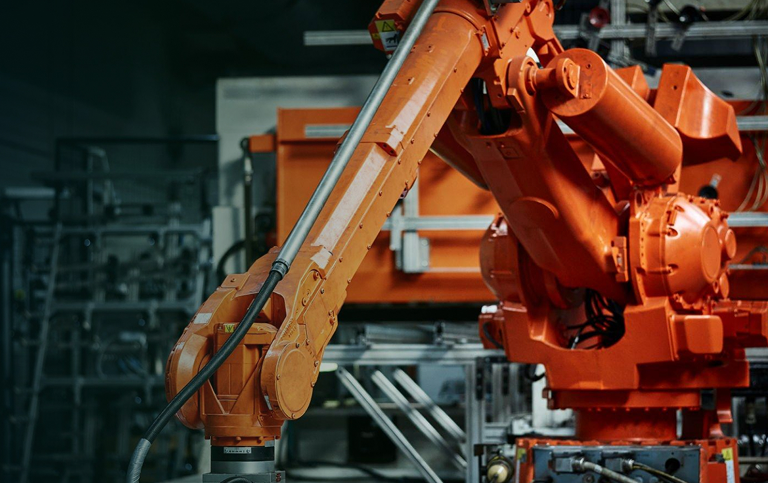

U.S. Antimony Refinery

Singta is developing the first large-scale U.S. antimony refinery

~60,000 T/Year

Huge feedstock capacity designed to handle large-scale mineral processing for domestic needs.

Hudson Dunes

Strategic partnership ensuring a long-term, secure supply chain for refinery feedstock.

99.9%+ Purity

High-precision refining producing premium antimony metal and oxides for advanced industries.

Defense & Aero

Providing essential materials for ammunition, batteries, and flame retardants in high-tech sectors.

Vs. China Lead

A direct strategic response to reclaim domestic control over the 80%+ Chinese market lead.

Why Antimony Matters

U.S. + Middle East

Processing Footprint

Texas (U.S.)

Defense, domestic stockpiling, and secure mineral supply chain.

Saudi Arabia

Energy-advantaged refining and global distribution network.

Built for Scalability

Built for redundancy and geopolitical resilience. Antimony is the first vertical — the platform scales.

U.S. Antimony Refinery

Source

Long-term feedstock contracts secured for consistent supply.

Refine

Owned U.S. & Saudi smelters capture high margins.

Supply

Contracted offtake to defense and energy buyers.

Stockpile

Strategic inventories sold at premium to governments.

Optimize

Trading, logistics, and strategic timing arbitrage.

Hudson Dunes

$2.5B+

01Trading Revenue

Proven profitability across a massive global trading infrastructure.

22

02Active Lines

Strategic trade lines connecting major global hubs and markets.

44+

03Recurring Buyers

Established market liquidity with high-tier recurring industrial buyers.

100%

04Secure Supply

Long-term supply security for our first large-scale U.S. refinery.

Strategic Infrastructure

Strategic Benefits

Feedstock Supply

Long-term supply for Singta's refineries ensures 100% uptime.

Immediate Offtake

Direct liquidity for refined products through established channels.

Trading Margins

Capturing incremental optimization margins at every stage.

Market Intelligence

Unmatched pricing visibility and global market insights.

Ready to Secure the Future of

Critical Minerals?

Join us in building a resilient and sustainable supply chain for the world's most essential strategic metals.

Contact Investor Relations